Перевод и анализ слов искусственным интеллектом ChatGPT

На этой странице Вы можете получить подробный анализ слова или словосочетания, произведенный с помощью лучшей на сегодняшний день технологии искусственного интеллекта:

- как употребляется слово

- частота употребления

- используется оно чаще в устной или письменной речи

- варианты перевода слова

- примеры употребления (несколько фраз с переводом)

- этимология

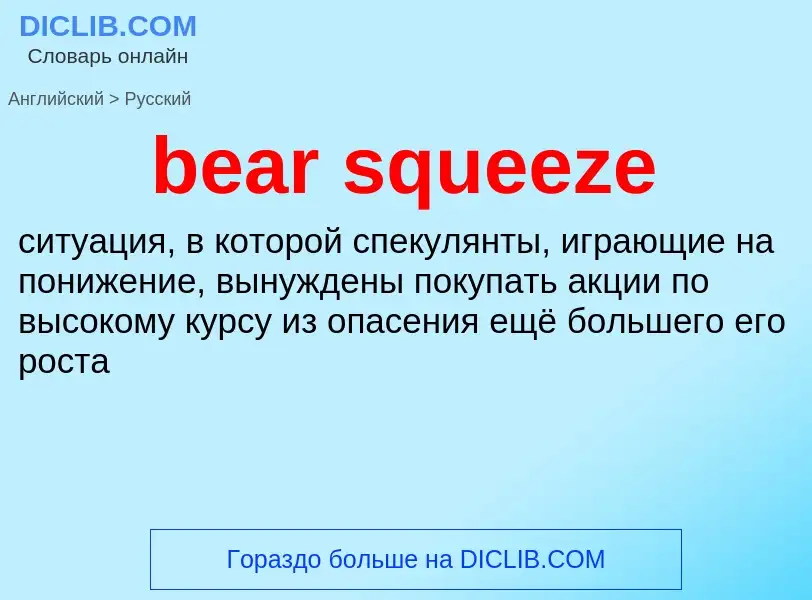

bear squeeze - перевод на русский

сумма ценных бумаг, проданная без покрытия, путём заимствования их у брокеров (игра на понижение)

2) ограничение (кредита) || ограничивать

3) разг. тяжёлое положение; затруднение; узкое место

4) см. bear squeeze

- squeeze down prices

- squeeze out

- bear squeeze

- credit squeeze

- financial squeeze

- food squeeze

- full employment profit squeeze

- liquidity squeeze

- money squeeze

- price squeeze

- profit squeeze

- short squeeze

общая лексика

литье под давлением

металлургия

штамповка жидкая

['beəgɑ:dn]

существительное

общая лексика

шумное сборище

место попойки

драк

история

медвежий садок

место травли медведей

существительное

общая лексика

травля медведя

общая лексика

очковый медведь (Tremarctos ornatus)

Википедия

The short interest ratio (also called days-to-cover ratio) represents the number of days it takes short sellers on average to cover their positions, that is repurchase all of the borrowed shares. It is calculated by dividing the number of shares sold short by the average daily trading volume, generally over the last 30 trading days. The ratio is used by fundamental and technical traders to identify trends.

The days-to-cover ratio can also be calculated for an entire exchange to determine the sentiment of the market as a whole. If an exchange has a high days-to-cover ratio of around five or greater, this can be taken as a bearish signal, and vice versa.

The short interest ratio is not to be confused with the short interest, a similar concept whereby the number of shares sold short is divided by the number of outstanding shares. The latter concept does not take liquidity into account.

![Engraving with dancing bear from [[Adam Olearius]]'s ''Travels'', 1647 Engraving with dancing bear from [[Adam Olearius]]'s ''Travels'', 1647](https://commons.wikimedia.org/wiki/Special:FilePath/Dancing Bear Adam Olearius Travels.jpg?width=200)

![''Bohemian Bear Tamer'', 1888 cast by [[Paul Wayland Bartlett]] ''Bohemian Bear Tamer'', 1888 cast by [[Paul Wayland Bartlett]]](https://commons.wikimedia.org/wiki/Special:FilePath/Bohemian Bear Tamer 01.jpg?width=200)

![A dancing bear in [[Pushkar]], India, 2003 A dancing bear in [[Pushkar]], India, 2003](https://commons.wikimedia.org/wiki/Special:FilePath/Pushkar-bear and handler.jpg?width=200)

.jpg?width=200)

![A painting of about 1650 by [[Abraham Hondius]] of a bear-baiting A painting of about 1650 by [[Abraham Hondius]] of a bear-baiting](https://commons.wikimedia.org/wiki/Special:FilePath/Bear-bating Abraham Hondius 1650.jpg?width=200)

![A bear and bull fight in [[New Orleans]], 1853 A bear and bull fight in [[New Orleans]], 1853](https://commons.wikimedia.org/wiki/Special:FilePath/Bull and Bear Fight New Orleans 1853.jpg?width=200)

.jpg?width=200)

![Spectacled bear at the [[Houston Zoo]] in Texas, US Spectacled bear at the [[Houston Zoo]] in Texas, US](https://commons.wikimedia.org/wiki/Special:FilePath/Spectacled Bear - Houston Zoo.jpg?width=200)

![Spectacled bear at [[Tennoji Zoo]] in [[Osaka]], Japan Spectacled bear at [[Tennoji Zoo]] in [[Osaka]], Japan](https://commons.wikimedia.org/wiki/Special:FilePath/Spectacled Bear Tennoji 2.jpg?width=200)

![At the [[Cincinnati Zoo]] At the [[Cincinnati Zoo]]](https://commons.wikimedia.org/wiki/Special:FilePath/Tremarctos ornatus 25.jpg?width=200)